It's Easy (and Free) to Create Your Jewish Legacy via IRA Beneficiary Designations

- JCF

- Jul 17, 2025

- 2 min read

The Jewish Community Foundation, Inc. and entire Southern New Jersey Jewish community has participated in the Life & Legacy initiative of the Harold Grinspoon Foundation since 2014.

During this timeframe, over 600 individuals or couples have committed to creating a Jewish legacy since it's easy to do and there is no minimum dollar amount that will benefit future generations via gifts that grow endowment funds.

Numerous financial vehicles exist for donors to leave a legacy gift, but the option we will discuss here is designating a portion of one's individual retirement account (IRA) to charity.

Many Americans use IRAs to save for retirement during their working years, in order to utilize the IRA's tax benefits and the "magic" of compound growth of stocks and other investments to increase their savings for the future.

Ultimately, any dollars left in the IRA after one's lifetime will have to be designated somewhere. Most donors choose to leave the bulk of the IRA's balance to loved ones such as their children or grandchildren, which is a wonderful gift to them.

But it's also an opportune time to leave a portion of an IRA to benefit nonprofits that they have long supported, via a legacy gift. Any IRS-qualified 501(c)(3) organization such as the Jewish Federation of Southern New Jersey and its family of agencies or Jewish day schools or synagogues can be a beneficiary of an IRA.

As an example, in a scenario where an individual has two children, the IRA owner can leave, say, 45% to each child to total 90% of an IRA, and the remaining 10% can benefit the charity(-ies) of their choice.

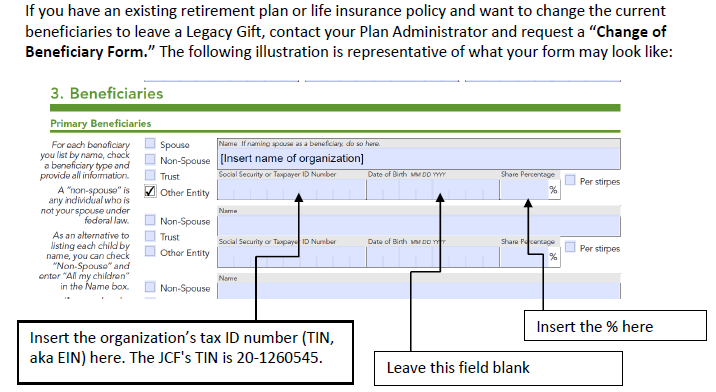

A huge benefit of leaving a gift in an IRA is that there is no cost to update one's beneficiary designations, and it typically only takes a few minutes to make the change, usually in an online account or by completing and submitting a paper form. Please refer to the sample of how a beneficiary designation form may look at the bottom of this post.

By designating the JCF as a beneficiary and letting us know ahead of time that the gift has been established, your IRA payout will be added to an endowment fund or launch a new fund in your name that will provide annual income to the selected nonprofit(s) of your choice, lasting many future generations. Plus, the organization(s) that you select may benefit by earning an immediate incentive grant through the Life & Legacy initiative. Simply initiating a legacy gift is a prime way to support your favorite causes now and in the future.

If you are considering leaving a legacy gift in your IRA to benefit a Jewish organization in the Southern New Jersey community, please contact that organization directly and/or JCF Assistant Director Mike Staff at 856-673-2528 or via email to guide you along and ensure your gift meets your philanthropic goals.

Thank you for considering leaving a generous legacy, and future generations will be thanking you as well!

Sample Beneficiary Form:

Comments